No, it was you who immediately lied about me evading tax payments!

You're still lying!

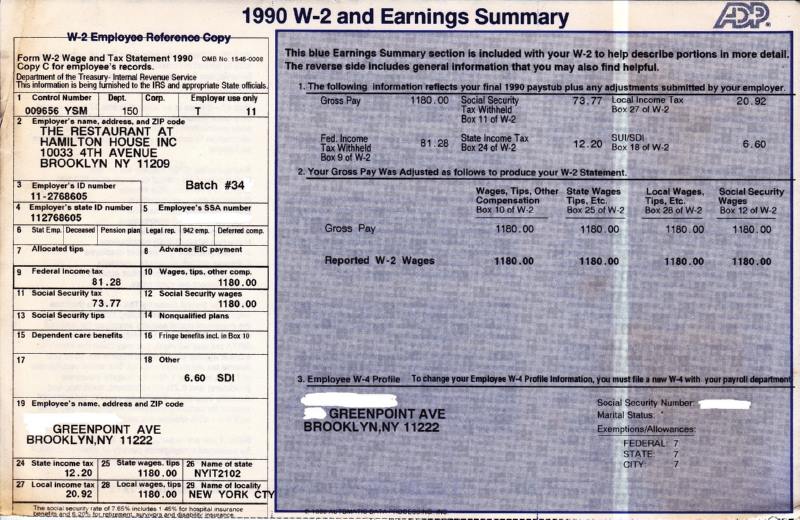

Your W-2 shows only what your one employer said they paid you as an employee in 1990: $5,226.75

But you said earlier:

After a year I saved 11.000 $

So where did this other money come from? :)

The standard deduction for single filers in 1990 was $5,300.

If you only earned $5,226.75 then yes you were owed a refund of $73.25.

But if you actually made $11,000 in wages, salaries and tips (i.e., all sources of income) then you still owe taxes even today on it! :)

How much? Let's do the math!

$11,000 (Wages, Salaries and Tips) - $5,300 (Standard Deduction) = $5,700 (Taxable Income)

irs.gov/pub/irs-prior/f1040ez--1990.pdf

If your Taxable Income is at least $5,700 but less than $5,750 then according to 1990 Tax Tables your tax amount still due is $859!

irs.gov/pub/irs-prior/i1040--1990.pdf

Like I said earlier there is no statue of limitations according to the IRS for not filing a return and especially for not paying taxes still owed.

This is why forms going back to 1990 are still around because of freeloaders like you!

So how much?

The earliest calculator I could find online goes back to 2020.

2020taxresolution.com/calculate-your-liability/

If 2020 had been your filing date to pay the $859 then this would mean that today

your Estimated Balance Due $2,253.81!!!