Ok my bad I didn't check your picture but

>Not really, unless you're very young or you don't have a great job.

he didn't say in what character he will work of cores its important

but that wasn't his question

>very young or you don't have a great job

That's what I said for a "singe person"

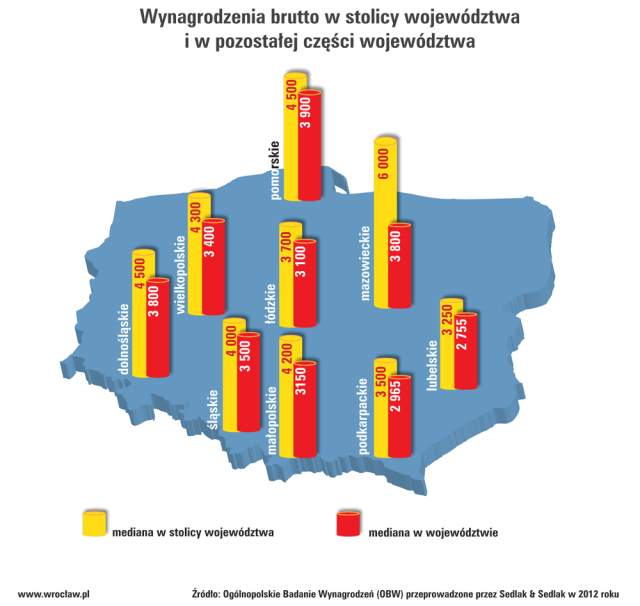

Generally earnings of "typical" workers aren't much bigger in Warsaw then else ware

It's the top positions that are paid well

Meanwhile, in Warsaw waiter earns an average of only about 250 zł more than outside of the capital. About the same level higher are nurses earnings , warehouse gets about 280 zł more, cashier - 450 zł and the driver with a license category B - 500 zł, the same greater is a statistical assistant salary in the marketing department or telephone consultant. A little bit better is among front desk staff and secretaries (median salary higher than 650 zł).

Good to be a manager.

It is different in professions that require some education.

Source: warszawa.gazeta.pl/warszawa/1,34889,9016552,Zarobki_w_stolicy__Komu_w_Warszawie_zyje_sie_lepiej_.html

Also what would you tell poles working for 2000 or 2500 a month?

Not even mentioning those working for minimal 1200 after tax (I genuinely respect those people they must be survival experts)

So it comes to

Is it possible to live comfortable in Warsaw for 4200zł a month

Yes it is

Is is 4200 a good pay?

answer is it depends

but he didn't ask about our opinion on pay for his position

PolishForums LIVE / Archives [3]

PolishForums LIVE / Archives [3]