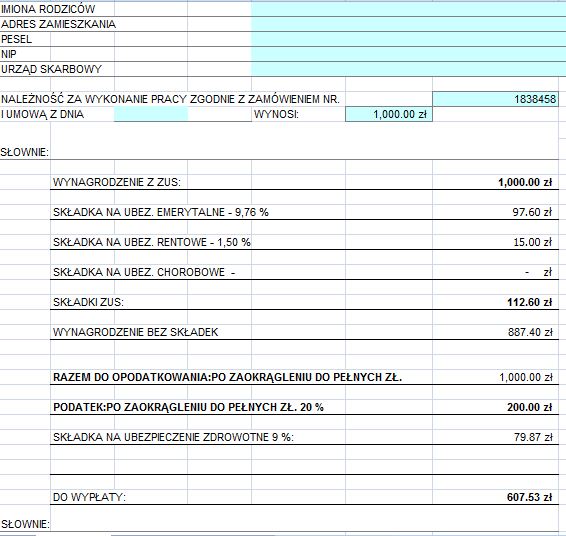

I just found out that under Polish law, as I am a contract worker and don't have residency status, that my personal tax allowance is 'put by' and can only be claimed at the end of the financial year (next February).

As it stands I'm being deducted about 40% of my gross, whereas if I had the allowance then it would be about 23%, which is a lot more palatable.

I've been told that if I have residency status then I will be taxed 'normally' and so the allowance will be calculated into my salary each month.

I'd really rather have it in hand then, but apparently it takes 3 months to get residency status. Is that true, or can I apply for and get a residency card/paper/number sooner than that?

Thanks for any info and advice,

Matt

As it stands I'm being deducted about 40% of my gross, whereas if I had the allowance then it would be about 23%, which is a lot more palatable.

I've been told that if I have residency status then I will be taxed 'normally' and so the allowance will be calculated into my salary each month.

I'd really rather have it in hand then, but apparently it takes 3 months to get residency status. Is that true, or can I apply for and get a residency card/paper/number sooner than that?

Thanks for any info and advice,

Matt

PolishForums LIVE / Archives [3]

PolishForums LIVE / Archives [3]